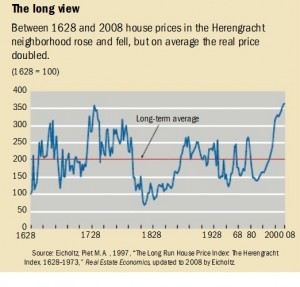

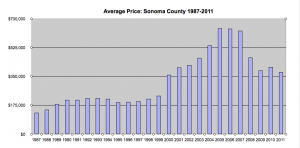

The moment someone buys a home, that is the moment inflation on housing expenses stops. While rents go up, your mortgage payment remains the same (in case of a 30 year fixed), for the coming 30 years. During the time that your mortgage payments stay the same, home prices fluctuate. However, over the long haul home prices do go up. If you doubt my statement, ask your parents/grandparents how much they paid

The moment someone buys a home, that is the moment inflation on housing expenses stops. While rents go up, your mortgage payment remains the same (in case of a 30 year fixed), for the coming 30 years. During the time that your mortgage payments stay the same, home prices fluctuate. However, over the long haul home prices do go up. If you doubt my statement, ask your parents/grandparents how much they paid

for their home way back when. When we lived in Leerdam (Netherlands), we lived in an older home, built in 1927, these homes initially sold for 27 guilders. At the time we bought it, you couldn’t even buy a washing machine for this amount 😉 Conclusion: Buying home is also a great long term investment vehicle.

for their home way back when. When we lived in Leerdam (Netherlands), we lived in an older home, built in 1927, these homes initially sold for 27 guilders. At the time we bought it, you couldn’t even buy a washing machine for this amount 😉 Conclusion: Buying home is also a great long term investment vehicle.

But it is always good to diversify. Recently I spoke with Matt Schweifler, a great local financial planner about this subject. He mentioned an other ‘safe’ great investment vehicle: bonds. When you buy a bond you receive interest every year and you have a guaranteed return of your investment at maturity date of the bond. Between the moment of purchase and the moment of maturity, the value of the bond will fluctuate, but at the end there is the guaranteed return on investment…

What do these 2 have in common? The value of your home, matters only when you either buy or sell. In case the home values in your area go up, this is great, but realistically this only matters when you decide to sell. The same is the case when you buy a bond, between the date you buy it and the date you sell, the value may go up, may go down but that only matters in case you decide to sell before the maturity date.

What do these 2 have in common? The value of your home, matters only when you either buy or sell. In case the home values in your area go up, this is great, but realistically this only matters when you decide to sell. The same is the case when you buy a bond, between the date you buy it and the date you sell, the value may go up, may go down but that only matters in case you decide to sell before the maturity date.

BTW. How much time did you spend on planning your last vacation? How much time do you spend each year planning your retirement? While Real Estate is a great investment vehicle, you really need other investment vehicles too…

Mirjam