Operation Twist is the economic policy from the FED: at their last official meeting in August, the policy making committee decided to keep interest rates low until 2013 …

This is good news for buyers… There is a time window to benefit from low interest rates… Time to get once’s financial house in order…

Some might think that waiting to buy is a better option, they decide to stay on the sideline… Smart idea???

Well depending on your situation: if you rent a home you pay for someone else’s mortgage. Why rent when you can buy? All the first time home buyers I have been working with recently end up paying less in mortgage than in rent…

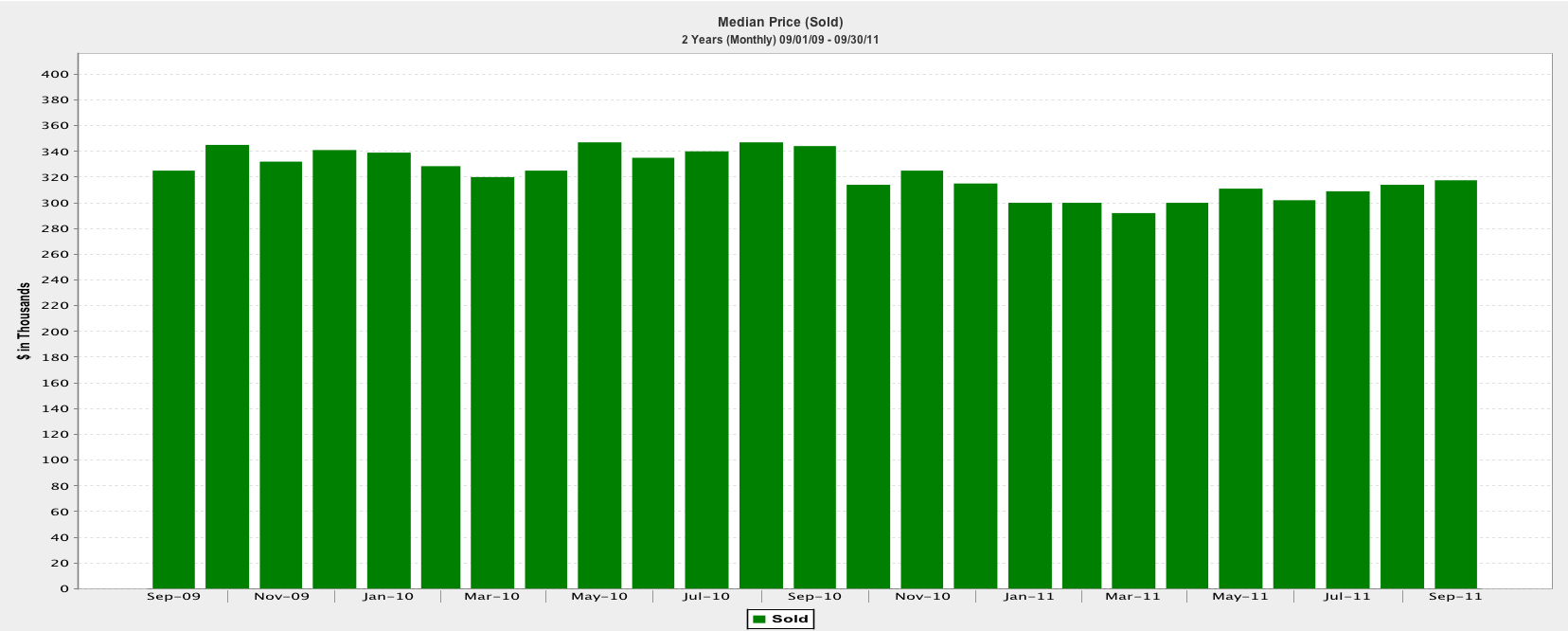

Will home prices go down further? All Real Estate is local. While the higher end in Santa Rosa/Sonoma County is expected to loose some more value in the coming time, the lower prices homes have been fairly stable in the last years.

But what if home prices are coming down a little further? You never know when the market has hit bottom until it goes up again. At that point there will be a lot more competition.In the mean time: you have to live somewhere, might as well pay your own mortgage and take advantage of the tax benefits when owning a home…

Bottom line: the current market in Sonoma is a great market for buyers: although the inventory is low, there are great homes coming on the market all the time. There is no such thing as the perfect home. But right now there is the luxury of not having to worry about interest rates going up dramatically.

Last note: in Netherlands most rental homes are owned by the government, our first home after we got married was government owned. Home ownership is becoming more common but not like in the USA. It’s called the American Dream for a reason.

Have a great weekend and enjoy harvest season in Sonoma County: the first weekend is the 13th Annual Wines and Food Affair

Mirjam