A few days ago I had coffee with David Carter, he is a reverse mortgage specialist at BofA. When I initially heard about reverse mortgage I thought is was some sort of a scam… I was wrong. As with any loan product, a reliable specialist is key and David is a specialist.

Recent legislation and changes in the marketplace are increasing the use of reverse mortgages. Here are three factors that make reverse mortgages an improved retirement-planning tool.

1. Fees are lower. The government, with support from lenders, has revised how reverse mortgages are structured.

2. Loans are more flexible. New loans let borrowers take money as they need it instead of all at once.

3. Selling isn’t always wanted, someone likes to stay in his/her house but need some extra income.

You can make payments on your mortgage but you don’t have to. This basically means that you cannot be foreclosed on when you don’t pay the mortgage.

You have to be 62 or older. For more information, contact David Carter: 707.235.8786.

Fall is beautiful in the wine country, visiting wineries, taste and discover new wines… Found a great winery with a deck where you can enjoy a picnic as well as the views: Everett Ridge Winery in Healdsburg

Have a great day!

Mirjam

OK, all the articles in the papers about home owners in foreclosure, in some states the whole process takes about 2 years minimal while in other states like California, it takes 3 months and 3 weeks minimal. It is relatively simple, but an important and often misunderstood part of the foreclosure process.

Judicial

A “judicial” state requires a judicial review of the foreclosure case before it can be officially processed. The foreclosure process actually begins by filing a Lis Pendens (“a lawsuit pending”) document in a court of law. Following are the states that require judicial review: Connecticut, Delaware, Florida, Illinois, Indiana, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Nebraska, New Jersey, New Mexico, New York, North Dakota, Ohio, Pennsylvania, South Carolina, Vermont.

Non-Judicial

In “non-judicial” states, lenders or trustees file a Notice of Default with the county recorder’s office to commence the foreclosure process, and the process does not need to go through the courts. These states include Michigan, New Hampshire, Tennessee, Utah, Washington D.C., West Virginia.

The remaining 25 states allow both judicial and non-judicial foreclosure, though some have tendencies toward one practice or the other. California is one of them and most foreclosures are non-judicial.

For some additional clarification, Thomas Lawler, former director and senior vice president at Fannie Mae, recently provided this informative explanation in a post for The New York Times:

“Some states allow both judicial and non-judicial foreclosures. … And in some states, judges have enormous discretion as to how to handle a foreclosure. … In many judicial states, foreclosures can be challenged, and such challenges have increased drastically.”

This distinction has become increasingly visible due to the recent “foreclosure freezes” by major lenders nationwide, most of which initially halted foreclosure proceedings in the states requiring judicial review.

At this point none of the major banks has a foreclosure freeze in California.

Mirjam

Do you know people who have been living in their house for a few years now without paying their mortgage? Wondering when something is going to happen? Well I see the trend changing. Recently I have been talking to home owners who have diligently been working on their loan modification,and nothing is happening so far and now all of a sudden a Notice of Default is filed. It seems like investors are getting fed up with loan servicers -the bank you are talking to to get your modification done- who take so long to make a decision. In our area, this means that if you are not careful, the bank will sell your house -foreclose- while you are still under the impression that you are working on a loan modification. Last year, when a homeowner was receiving a Notice of Default, nothing was going to happen within a short period of time. This has changed, now I see it happening more and more that a bank will move forward with the Notice of Trustee sale 3 months after the Notice of Default has been filed. And 3 weeks after the Notice of Trustee sale, the Trustee Sale will take place -> this is what we call the foreclosure.

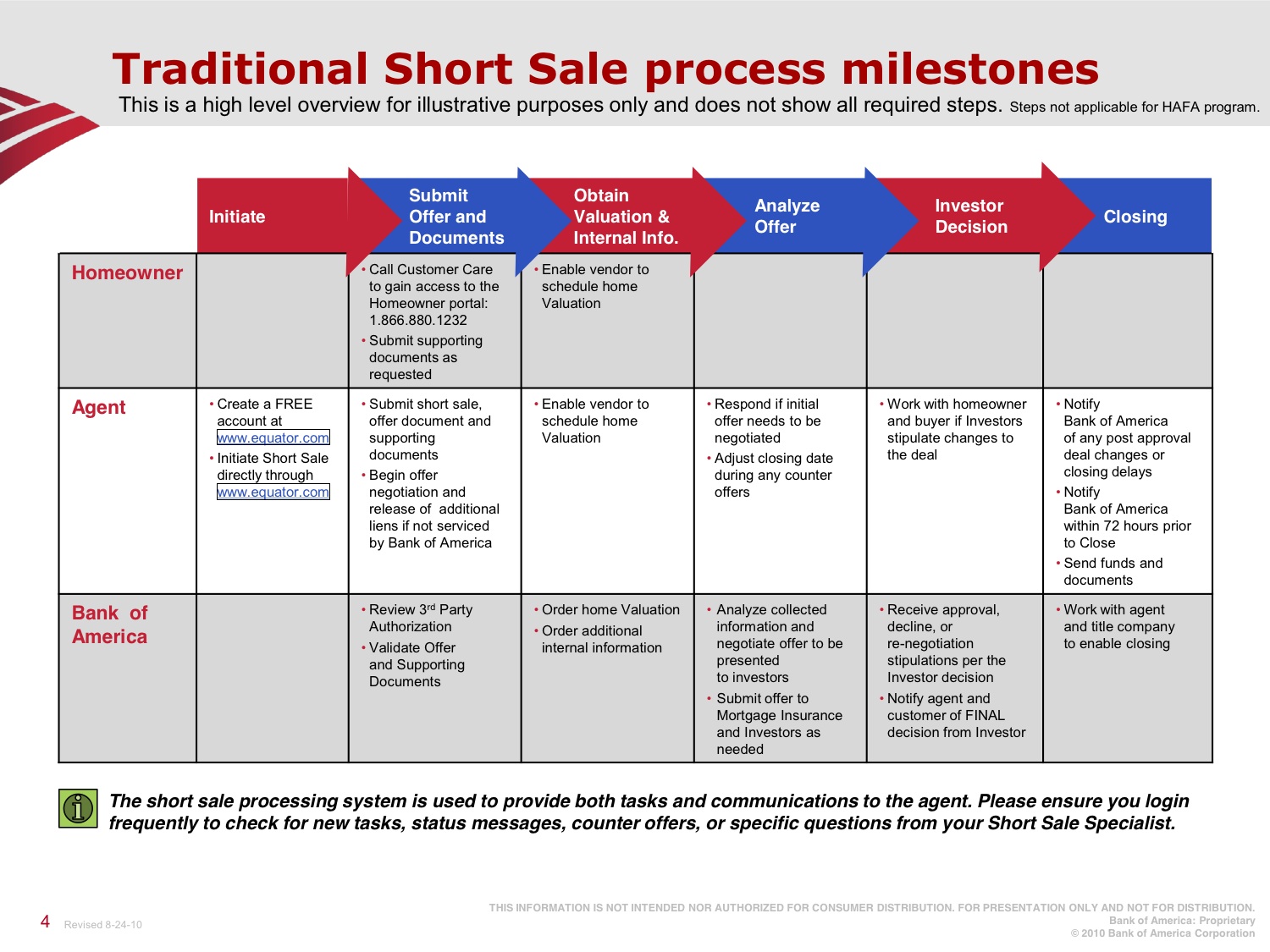

If you want to avoid a foreclosure, a short sale is a good alternative for a lot of distressed home owners. One of the benefits is that you are more in charge of the situation, you can negotiate the deficiency,

A few months ago, CDEP posted that Freddie Mac reported its short sale volume was up 600%. Today, REOInsider reported that “short sale volume is up more than 150% from volume in 2Q09, according to the Federal Housing Finance Agency’s second quarter government-sponsored enterprise (GSE) ‘Foreclosure Prevention & Refinance Report.’”

Short sales are on the rise nationwide. More and more agents are receiving training in assisting distressed homeowners, and there is a movement to provide solutions to these homeowners facing foreclosure. Your truly did some extensive training to be able to help distressed home owners with alternatives to foreclosure.

Mirjam

With millions of homeowners struggling to pay their mortgages, you or someone you know may need the best information on what steps to take next. Before deciding this, it’s important to understand the consequences of and alternatives to foreclosure.

A short sale is a dignified solution to foreclosure with less effect on finances, future loan eligibility, employment, security clearance and other factors. I’ve created a free report explaining the different results of short sales and foreclosure, which you can download here:

http://hosted.cdpe.com/14365/

As a CDPE-designated agent, I can assess all of your available options and help you move in a positive direction. I’m here to help, and only a phone call or an email away.

Mirjam