In today’s housing market, the media’s continued focus on negative real estate news is keeping many people solidly on the sidelines. But remember, you are not getting the whole story.

FACT #1: THERE IS STILL OVER $23 TRILLION OF VALUE IN U.S. HOUSING STOCK. Home ownership continues to be the basis of our wealth in this country.

FACT #2: THE HOUSING MARKET CANNOT HELP BUT GROW. Our country’s tremendous wealth, liquidity, and entrepreneurship will continue to drive our economy. 70-100 million people will be added to our market in the next 40 years.

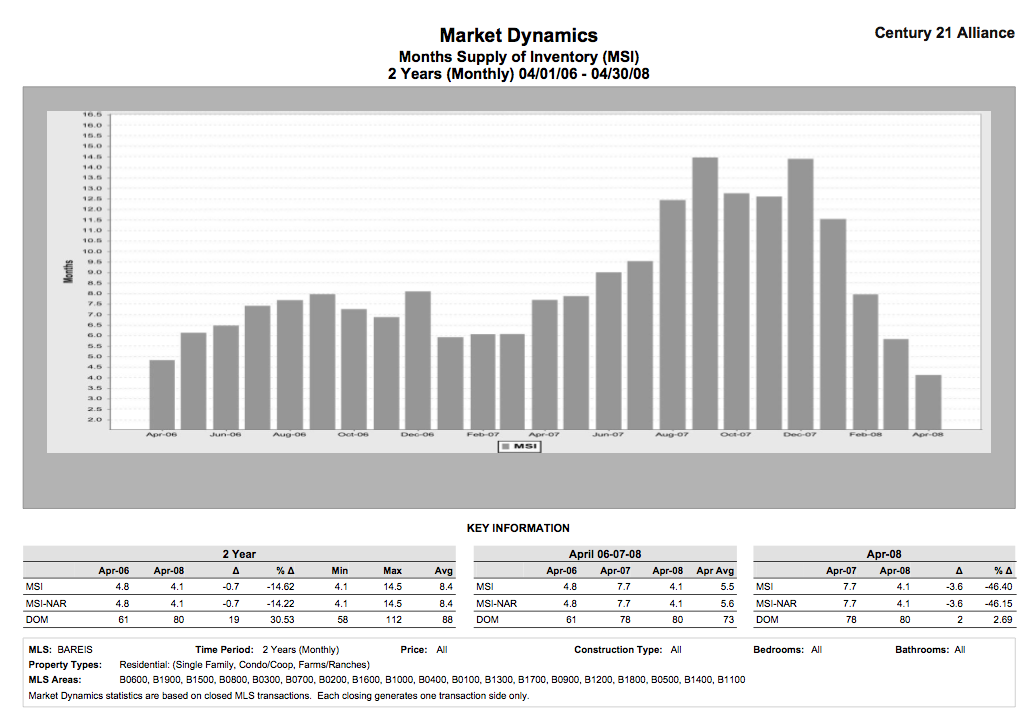

FACT #3: REAL ESTATE IS CYCLICAL. The biggest fear in good times is that the fair weather won’t last forever—because it doesn’t. But the reality of a cyclical real estate market also provides its brightest hope in bad times—foul weather won’t last forever either. What’s happening today is a market correction, severe in some places, but it’s not the end of the world. The markets will stabilize.

FACT #4: 2008 IS THE BEST YEAR TO BUY A HOME IN 35 YEARS. 1973 was the last time mortgage rates were this low in a buyer’s market. We had rates this low in 2001 and 2002, but those were strong seller’s markets with little inventory. The last two big buyer’s markets, in the early ‘80s and early ‘90s had much higher rates. Low rates and good inventory make 2008 the best year to buy in decades!

FACT #5: FIRST-TIME BUYERS HAVE A REAL ADVANTAGE IN TODAY’S MARKET. First-time buyers can buy at a reduced price without having to sell at one too. Higher limits on lower cost conforming loans also help first-time buyers purchase more home for their money. Today’s ‘starter’ homes can be pretty impressive.

FACT #6: FIRST-TIME BUYERS LOSE MONEY WHILE THEY WAIT ON THE SIDELINES. First, renters typically pay more state and federal income taxes than homeowners with a mortgage deduction. Renters are also losing the wealth they could be accumulating as they pay down their mortgage and as their home increases in value over time (as it surely will). Lastly, renters who wait to buy will lose money if interest rates increase by the time they finally act. Higher payments from higher interest rates represent money buyers could have kept if they had bought earlier. Conversely, if they were willing to spend that amount of money earlier, they could have bought more home.

FACT #7: HOMES SELL WHEN THEY’RE PRICED RIGHT AND SHOW WELL. When sellers make their home’s value obvious, they make a sale—it’s as simple as that. The facts are showing this. In Sonoma County we see investors coming back into the market.

… Have a great day!

Mirjam (707) 486-2638