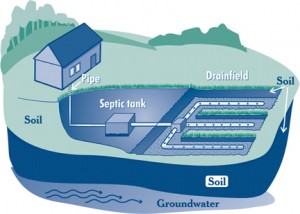

Looking for that perfect home in Sonoma County? Depending on what you are looking for, changes are it is not connected to a sewer system but has it’s own waste water system, called a septic system. About 25% of all properties have their own septic system. Without going into details as to upcoming and ongoing changes in the requirements for septic systems -see this link- it is important to know whether the property you are buying or selling has a working septic system. It is one of the inspections to do when purchasing a property with a septic system.

Looking for that perfect home in Sonoma County? Depending on what you are looking for, changes are it is not connected to a sewer system but has it’s own waste water system, called a septic system. About 25% of all properties have their own septic system. Without going into details as to upcoming and ongoing changes in the requirements for septic systems -see this link- it is important to know whether the property you are buying or selling has a working septic system. It is one of the inspections to do when purchasing a property with a septic system.

Over the years I have had several situations where either sellers would refuse to do a septic system before putting their home on the market, or buyers not seeing the need to do a septic inspection. Let’s just say that the buyer who initially wanted to waive that inspection was really glad afterwards. The system had some problems which would have cause failure in the future. On a recent transaction, the seller had to put in a sew septic tank since the septic inspection brought to light that the wall in the tank had a hole in it. Luckily the seller was a contractor who had the resources to do this quickly.

Before moving to Santa Rosa, I had never lived on a property with a septic system. My grandparent had a farm in Netherlands, they had a septic system but quite frankly I never knew much about that. The house we live in right now is depending on a septic system for waste water. It’s not scary, it part of living in a more rural part of Sonoma County and I think it a great way to recycle 😉 Sidenote: click here if you like to learn more about septic systems.

Currently I am working to put a property on the market in Franz Valley, a small home on 9 acres. It’s on a beautiful location, there are 2 ponds on the property and yes, the house is on a septic system. We are doing a septic inspection before putting the home on the market, a local company, BDK septic services, will first pump the tank and then inspect the system.

Bottom line, for buyers and sellers: do the proper inspections before buying or selling property, you will be glad you did;)

Mirjam