This week there were 2 interesting updates: BofA is going to announce a major change in the way they work with agents. They are changing their systems to approve short sales within 2 weeks of an offer. Currently I am working on 2 short sales with BofA and am waiting for approval of the authorization letter for 4 days now. CDPE will have an interview with a Short Sale Exec on January 20.

Next, the Making Home Affordable HAFA guidelines are changing per February 1st. The servicer is no longer required to verify any financial information as to monthly income exceeding 31%. The property can be vacant or rented out for up to 12 months prior to the Short Sale application -> still had to be your primary residence. The other changes have to do with release of subordinate liens, timing to respond, timelines and deed-in-lieu programs.

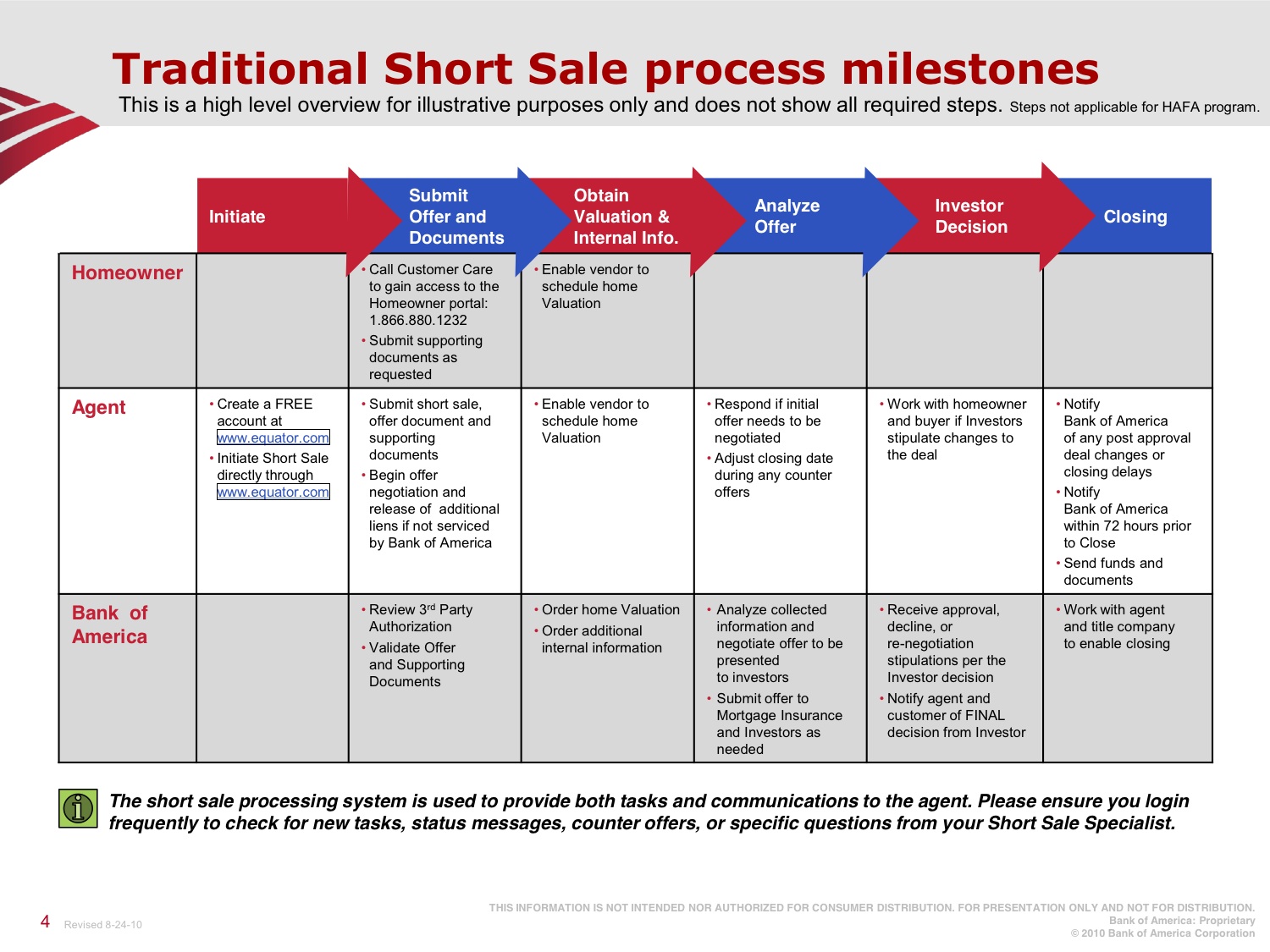

Short Sales are a dignified way to get out of a financial difficult situation, a seller stays in control, also as to the financial consequences, is able to negotiate to a certain degree and able to anticipate the consequences.

In 2010, about 50% of all the sold properties was either a short sale or a foreclosure. It is expected that the coming year will be about the same. It will be interesting to see what will happen this year.

On a happy note: next week is the 19th Winter Wineland, check out the website. A great event with 140 wineries participating.

Mirjam