This weekend’s open house at 2390 Baggett Drive was a great success. Most people that came to see the house were seriously looking for a new home. Together with the feedback from other agents that investors have started ‘bottom fishing’ and that some of the ‘great deals’ have attracted multiple offers I have come to realize that we sort of know were the market is at and that’s a good thing. Also the interest rates are historically low and might even go lower.

As promised some stats for Sonoma County, yes, our area has been hit hard in certain price ranges.We had a fairly high percentage of people that bought homes with the dreaded negative arm that adjusted recently. Our area is not as bad as other areas (Fresno for instance) but certain parts of Santa Rosa do have a lot of short sale listings and REO listings.

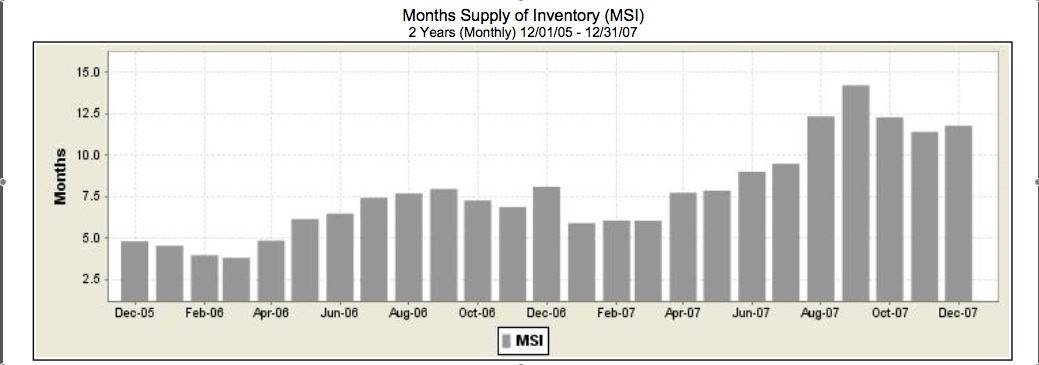

The first I am going to share is the 2 years overview of inventory:

As per December 31, we had 3385 properties for sale (Dec 2005: 2304) and in that same month 217 properties sold (Dec 2005 : 343). In 2007 March was the top month with 428 properties sold in that month. Interestingly enough, the year before the top month was in June with 522 properties sold. So no matter what you might think, homes DO sell, the numbers are proof of it.

Regarding the market: as Realtors, we do preview and show quite a bit of homes. It’s usually very clear why homes don’t sell: besides the pricing issue there is also the showing issue: a lot of homes show dirty, cluttered and not kept. It’s beyond my comprehension why people don’t at least clean their house before putting it on the market and keep it clean while being on the market. If you don’t do it for your prospective buyers, please do it for the poor Realtor that you hired to sell your house or the ones that preview or show your home: it’s depressing to show or preview a dirty house!

Thanks and have a great day!

Mirjam de Rijk (Mirjam@c21alliance.com)

From Bad to Worse???

It is really important to weigh the news in the press. Santa Rosa Jr. College has a spring forum to discuss the trends in Sonoma county. Mark your calendars and note below the latest information to consider:

“In November of last year, Chris Thornberg of Beacon Economics in Los Angeles presented his economic analysis for 2008 to Sonoma County: He suggested that a national recession is probable (75 percent chance of recession). The title of his presentation was “From Bad to Worse.” Thanks to Chris for his inspiring title.

In recent years, the SRJC Economic Development Institute (EDI) has offered the college community information about regional, national, and international economic conditions to assist SRJC’s planning and operations. (We gleefully also included egregious jokes ridiculing economists, apparently provoking unfair criticism of the profession.)”

The Spring Forum 2008, is a joint endeavor of the SRJC Economic Development Institute and the SRJC Institute for Environmental Education to promote dialogue at SRJC regarding environmental and sustainable technologies.

PLEASE MARK YOUR CALENDARS: SRJC Spring Forum: Friday, April 18, 2008, 7:30 am – 2:00 pm, Shone Farm. “Sustainable Society: Teaching the Environment at SRJC”. Information and reservations: Chuck Robbins, 527.4498, crobbins@santarosa.edu.

Now, for some news that we read about in our newspapers, saw on line or heard on TV/Radio:

America’s vulnerable economy: “In 1929, days after the stockmarket crash, the Harvard Economic Society reassured its subscribers: ‘A severe depression is outside the range of probability.’ In a survey in March 2001, 95% of American economists said there would not be a recession, even though one had already started.” Economist.com, November 15, 2007

Economy faces risks, not recession: Bernanke. “Federal Reserve Chairman Ben Bernanke told lawmakers on Thursday the U.S. economy did not appear headed for recession, but warned growth could prove weaker than expected and inflation higher.” Reuters, November 8, 2007

Housing drags on local economy: “Chris Thornberg, a Los Angeles economist, said rising unemployment and housing’s tumult are hammering the state’s economy, including Sonoma County.” The Press Democrat, November 12, 2007

Economists divided on recession, some see growth in 2008, others expect major gloom: “Some economists predict the U.S. economy will slide into recession next year. Others expect the nation to avoid recession, if only barely. A few even think the economy will see solid growth. But for many middle- and lower-income families, the distinction won’t matter… The outlook is the gloomiest in years, particularly for the first half of 2008. San Francisco Chronicle, December 26, 2007

Jobs: December’s Big Chill: “The U.S. economy added just 18,000 jobs on the month, sparking recession worries.” BusinessWeek.com, January 4, 2008

Jobless Rate Hits 5 Percent, 2-Year High: “Unemployment jumped to its highest rate in two years and new hiring slowed to a trickle in December as a cooling economy and continued downturn in the housing sector registered soundly in the country’s labor force.” Washingtonpost.com; January 4, 2008

Jobs data underlines weak growth: “The report confirms the fear that we are starting to dip into recession.” Reuters, January 4, 2008

Bush calls financial markets ‘strong and solid’ despite slowing economic growth: “President Bush said Friday that while there is some concern about slowing economic growth, the ‘financial markets are strong and solid.’” AP News, January 4, 2008

Study: Counties competing for jobs: “A study released Monday showed that California is competing less with other states to attract and retain companies, and more with itself. It turns out that relatively few jobs left California for other states. Far more moved around within the state, escaping high-cost areas near San Francisco and Los Angeles.” The Press Democrat, November 6, 2007

Sonoma County economy grew at snail’s pace: “… Sonoma County was the 10th largest regional economy in California in 2005, the most recent year available. In terms of growth, Sonoma County ranked fourth from the bottom of 26 regional economies in California, with annualized growth of 2 percent, after adjusting for inflation.” The Press Democrat, September 27, 2007

Fewer Marin high school graduates going to College of Marin: “College of Marin may be taking a ‘build it and they will come’ approach to its $249.5 million overhaul of its campuses. The school’s enrollment woes over the past 15 years are pretty stunning…. The charts show a steep drop in the number of Marin high school graduates who enter College of Marin as first-time freshmen. For instance, 39 Sir Francis Drake grads enrolled in College of Marin in 1992. Six did last year. Tamalpais’ numbers slid from 45 in 1992 to nine last year. Another example: Novato High dropped from 46 in ’92 to nine last year. At the same time, Marin high schools continue to send freshmen to Santa Rosa Junior College. Last year, according to the state, 61 San Marin High grads continued their education at Santa Rosa Junior College. Fifty-five Santa Rosa Junior College freshmen were from Novato, 21 from San Rafael High, 31 from Terra Linda High and seven from Drake. In 1992, only three Terra Linda grads entered Santa Rosa Junior College.” Marinij.com, November 2, 2007

The nation’s manufacturing sector has taken a turn for the worse: “A manufacturing index compiled by the Institute of Supply Management weakened to 47.7 in December….The tipping point for the index is 50, with a reading above that reflecting growth. A reading below 50 represents a decline in manufacturing.” Bizjournals.com, December 31, 2007

The conventional wisdom: Many folks believe that community college enrollments move inversely with the state of the economy: When the economy is down, community college enrollments go up; when the economy is up, community college enrollments go down. According to conventional wisdom, as the unemployment numbers increase (indicating a declining economy), SRJC enrollments should increase also. Please note the following numbers, keeping in mind that the U.S. economy, including Sonoma County, was in recession in the early years of this decade. Also please note that current U.S unemployment is 5%:

|

Year |

SRJC enrollments |

California Unemployment Rate |

U.S. Unemployment Rate |

|

2001/02 |

61,234 |

5.4% |

4.8% |

|

2002/03 |

60,353 |

6.7% |

5.8% |

|

2003/04 |

53,329 |

6.8% |

6.0% |

|

2004/05 |

50,668 |

6.2% |

5.5% |

More later…..

Denise

The article in yesterday’s Press Democrat titled “Slide to Continue” was ‘of-course’ about the ‘horrific’ Real Estate market was actually very interesting. Ashley Young -the example used in the article- did take advantage of the current market and bought her home in Windsor for $470,000. About 2 years ago that house might have sold for $630,000. I am proud of Ashley, she is taking advantage of the cycle in Real Estate. About 15 years ago we had the same type of market and at a seminar I recently attended some people mentioned that they bought in that down market 15 years ago and were glad they did.

Real Estate is worth the investment however…. in the long run. If you bought your home about 6 years ago your chances are about 100% that you will sell it for more than you bought.

So what will you do? Sell you house and move up to a house that is also less in value (less property taxes too)? Take advantage and make the difficult move to own instead of rent? Or start building your investment portfolio and purchase a rental property? The rental market is great and the rents will go up the coming years.

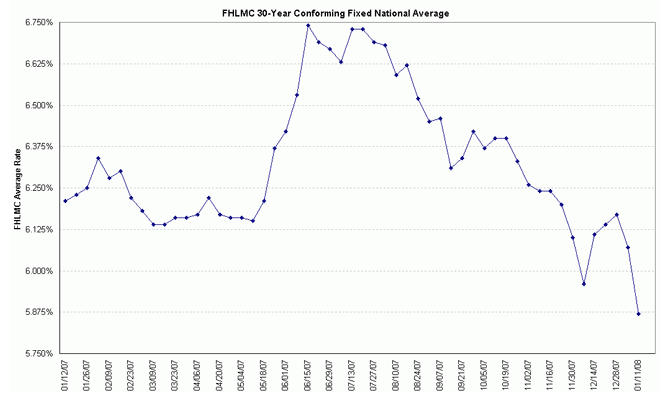

And despite of what you might think: interest rates are at an historical low and there are a lot of great programs available.

Have a great day!

Bring in the New Year! I have to announce that my new emphasis in ’08 will be on the small business owner. I have taken a position with a large bank and am responsible for small business banking in 4 “stores”. If you or anyone that you know is tired of dialing “1 800” and pressing 1,2,or3 and would like to speak to a real person that can assist you with your business banking ….call me. So in ’08 you will read about the exciting business trends, including real estate since I am still in commercial real estate, that are happening in Sonoma County. So look forward to exciting news and happenings here!!

Bring in the New Year! I have to announce that my new emphasis in ’08 will be on the small business owner. I have taken a position with a large bank and am responsible for small business banking in 4 “stores”. If you or anyone that you know is tired of dialing “1 800” and pressing 1,2,or3 and would like to speak to a real person that can assist you with your business banking ….call me. So in ’08 you will read about the exciting business trends, including real estate since I am still in commercial real estate, that are happening in Sonoma County. So look forward to exciting news and happenings here!!

Denise