| House Committee to Mark Up Mortgage Reform Bill; MBA Expresses Concerns |

MBA (11/6/2007 ) Sorohan, Mike

The House Financial Services Committee has scheduled a markup session today to consider H.R. 3915, the Mortgage Reform and Anti-Predatory Lending Act of 2007. The Mortgage Bankers Association, in a letter to committee members, continued to voice concerns over several aspects of the bill that it said could be harmful to consumers and the securitization market. H.R. 3915, introduced by committee chairman Barney Frank, D-Mass., with Reps. Mel Watt, D-N.C., and Brad Miller, D-N.C., would alter mortgage practices in several areas: establish a federal duty of care standard for originations; require licensing of all mortgage originators; prohibit steering; create an ability to repay standard; and attach limited liability to secondary market securitizers. Yesterday, Frank released a managers’amendment of the bill, which changes some aspects of the original bill.In MBA’s letter to Frank and ranking Republican Spencer Bachus, R-Ala., MBA President and CEO Jonathan Kempner and Senior Vice President for Government Affairs Kurt Pfotenhauer said that while the manager’s amendment makes several important and positive modifications to the bill, MBA continues to have “significant concerns” about several aspects of the bill, including the concept of “rebuttable presumptions” (which allows the presumption of meeting the conditions of a qualified safe harbor loan to be rebutted against a creditor); the continued absence of a uniform federal preemption standard; and a categorization of high-cost mortgages that MBA said remains “overly broad.”“These provisions, among others, will result in many Americans not receiving credit for which they would appropriately qualify and they prevent MBA from offering our support for H.R. 3915,” Kempner and Pfotenhauer wrote.On preemption of state and local laws, MBA has long-advocated a single consumer protection standard for all Americans. MBA said any bill passed by Congress should improve the mortgage process so consumers can be empowered with useful information; better align the incentives of brokers and other market participants with those of the borrower; and preempt state and local laws on this subject.“The proliferation of state and local lending laws has resulted in an uneven environment for both consumers and lenders,” MBA wrote. “Consumers do not have a single standard they can trust and lenders have to work with dozens of different standards around the country. In a national (international, in fact) mortgage market like ours, with a multitude of different regulatory and business models, a single strong standard would best serve the entire market. The Managers’ Amendment, as currently constituted, does not include broad federal preemption.”On the concept of rebuttable presumption, the managers’ amendment allows the presumption of meeting the conditions of a qualified safe harbor loan to be rebutted against a creditor. Kempner and Pfotenhauer wrote that MBA has “significant concerns because, as written, the Managers’ Amendment exposes a lender to liability even when loans satisfy the qualified safe harbor requirements. This undermines the true nature of a safe harbor, which, provided its conditions are met, should offset liability. The presence of rebuttable presumption will leave lenders guessing as to whether they will have liability making qualified safe harbor loans. This will result in them either not making these loans or increasing their cost.”The managers’ amendment requires that any successor in interest of a foreclosed property permit a tenant to reside at the property for 90 days. MBA said such a requirement hampers the sale of foreclosed properties furthering the blight of our neediest communities.And on high-cost loans, the managers’ amendment significantly expands the scope of loans that qualify as high-cost loans or HOEPA (Home Ownership Equity and Protection Act) loans, which MBA said lenders will not make because of the significant liability associated with them. “Wherever HOEPA standards are set, it creates a de facto usury ceiling,” Kempner and Pfotenhauer said. “We are particularly concerned with lowering the point and fee calculation to 5 percent, which would include prepayment penalties, yield spread premiums and most bona-fide discount points. By eliminating the opportunity for consumers to take advantage of these financing options, this low threshold will prevent legitimate mortgage lending and put homeownership out of the reach of many individuals.” |

| |

| Credit Situation Not That Bad, Report Says |

MBA (11/6/2007 ) Palaparty, Vijay

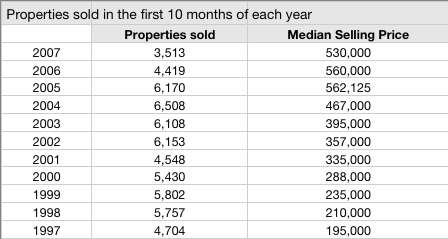

Headlines this past summer called attention to the credit crisis, primarily the result of the deterioriating subprime market. However, much capital still exists—the shortage lies in confidence, according to a report from The Brookings Institution. “Much of that gigantic pool of capital from around the world is still out there looking for something in which to invest and investors are still willing to consider real estate—including American real estate,” said Anthony Downs, senior fellow of metropolitan policy at Brookings and author of the report, Credit Crisis: The Sky is not Falling. “The outcries of Wall Street that there is a capital crisis is exaggerated—there is only a shortage of confidence in some of the instruments that Wall Street has invented to capture some of that capital. Though the resulting uncertainty has spread to banks and other financial institutions, plenty of capital is still out there and looking for a home.”Subprime mortgages account for only a small portion of all mortgages—between 1994 and 2005, 13 percent of all loans were subprime. This number rose to 19 percent in 2004 and 21 percent in 2005, according to data from the Mortgage Bankers Association. Delinquency studies as of mid-2007 from MBA revealed that at least 87 percent of mortgages were not subprime loans.Delinquency rates between 1998 and 2000 remained below 8 percent, rising between 10 percent and 13 percent through 2003, and declining again to below 8 percent since the fourth quarter of 2003. The delinquency rate among subprime mortgages is significantly higher indeed—among prime mortgages, the delinquency rate remained below two percent from 1998 through 2005.Next year is expected to see a rise in delinquency rates because of resetting mortgages as interest-only periods end and sustainable rates rise. But low unemployment should keep a desperate situation at bay—unemployment rates are currently at historic lows in the U.S., the Brookings report said.“These facts hardly indicate a credit crisis throughout the economy or even in mortgage markets. But the subprime mortgage problems do glaringly reveal the inadequate mortgage and other credit underwriting standards in practice during several recent years of high-volume, low-interest lending,” Downs said. “Subprime mortgage problems make many real estate lenders realize they should have been conducting more thorough underwriting, demanding higher-interest rates and putting more loan covenants into their deals.”Lending in all sectors, as a result, brought about shock where all risks were being weighed very carefully. Many lenders stopped making loans while others raised rates and guidelines. Reduced lending activity threatened credit markets worldwide.“The fear was encouraged because many complex securitized loan funds contained small portions of delinquent subprime mortgage,” Downs said. “If this seizing-up of credit markets became worldwide, that would slowdown economic growth everywhere—hardly a desirable outcome.”Markets worldwide show prosperity—European markets as well as emerging markets in Asia are growing. The slowdown in the U.S. economy has not impacted the growing gross domestic product rate or unemployment rate.“Although growth rates in developing nations are faster than the U.S. growth rate, our economy is still regarded as the safest and most politically secure place to invest in the world, despite the devaluing U.S. dollar. This is shown by the recent decline in the U.S. Treasury interest rates as lenders fled into Treasuries seeking guaranteed security. These are not the conditions likely to generate a financial crisis,” Downs said.The sustainability of real estate as an investment remains questionable. The U.S. residential market is expected to slow through 2008, hopefully recovering thereafter. In the commercial real estate markets, new construction to keep pace with sustainable design and technology developments could result in a surplus as investors build new properties instead of buying existing ones.“So real estate’s boom cannot last forever—nothing does—but it could last a lot longer than it has up to now,” Downs said. “There is still plenty of financial capital out there looking for somewhere to go, and there are still plenty of property markets around the world that present good development opportunities. In the absence of some catastrophic world crisis that would upset all forecasts, there is no reason to think we are in the midst of an inevitable credit crisis. Just look at the facts.” |

|